All About Property By Helander Llc

All About Property By Helander Llc

Blog Article

The Main Principles Of Property By Helander Llc

Table of ContentsUnknown Facts About Property By Helander Llc9 Simple Techniques For Property By Helander LlcThe Single Strategy To Use For Property By Helander LlcProperty By Helander Llc Fundamentals ExplainedThe Greatest Guide To Property By Helander LlcThe Ultimate Guide To Property By Helander Llc

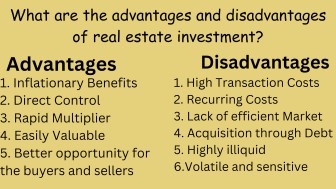

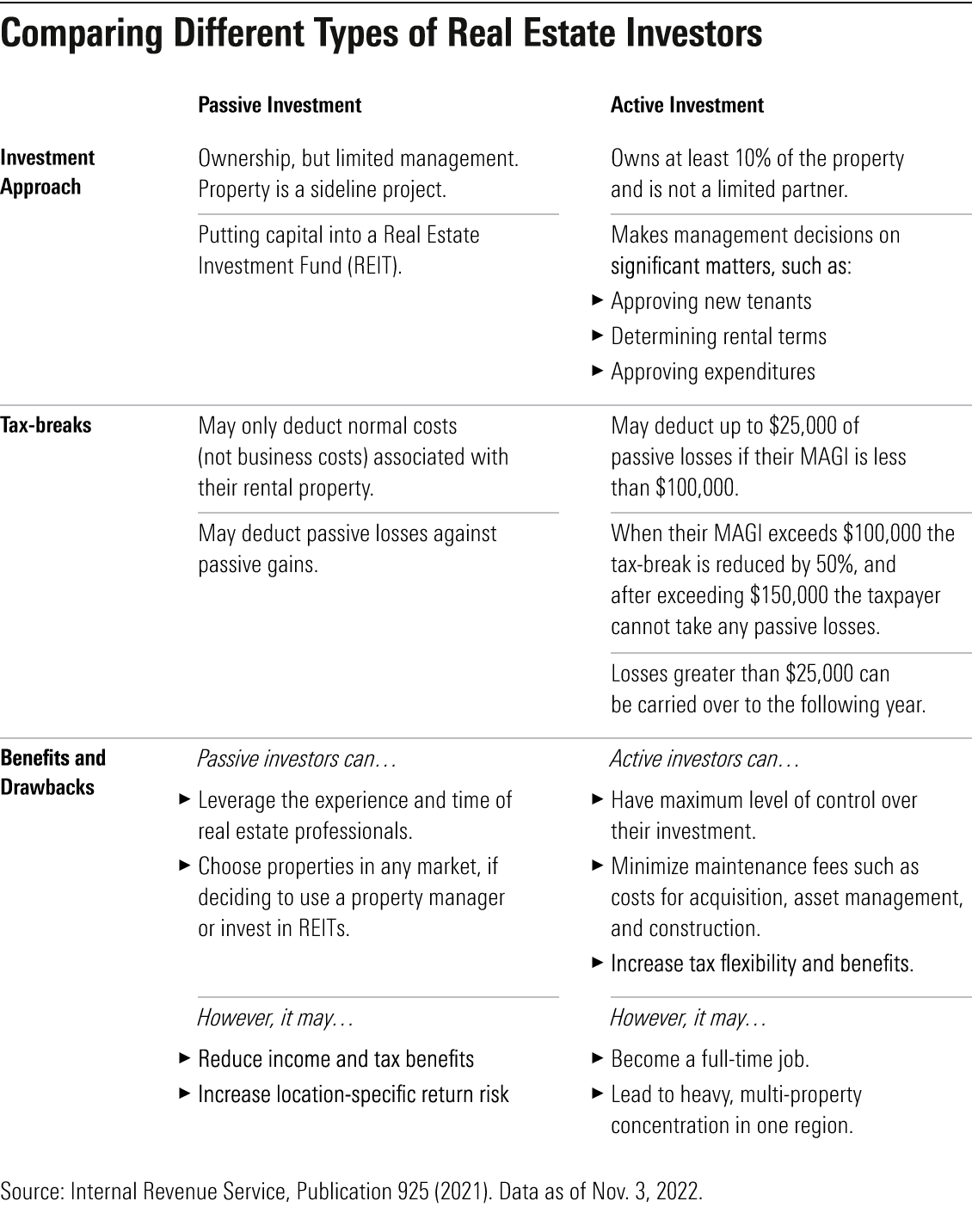

The benefits of buying property are various. With well-chosen properties, investors can take pleasure in foreseeable capital, exceptional returns, tax benefits, and diversificationand it's feasible to leverage actual estate to build wide range. Thinking regarding investing in realty? Below's what you require to understand about property benefits and why genuine estate is considered a good investment.The benefits of spending in real estate consist of easy revenue, steady cash money flow, tax obligation advantages, diversification, and utilize. Genuine estate financial investment depends on (REITs) use a way to spend in genuine estate without having to own, operate, or money residential properties.

In a lot of cases, capital only reinforces in time as you pay down your mortgageand accumulate your equity. Actual estate investors can make the most of numerous tax breaks and reductions that can save money at tax obligation time. Generally, you can deduct the sensible prices of owning, operating, and taking care of a building.

Facts About Property By Helander Llc Revealed

Real estate values often tend to raise over time, and with an excellent investment, you can turn an earnings when it's time to offer. As you pay down a building home mortgage, you construct equityan possession that's part of your net worth. And as you construct equity, you have the take advantage of to purchase even more residential properties and boost cash flow and riches even extra.

Due to the fact that realty is a tangible asset and one that can act as collateral, funding is conveniently available. Property returns differ, depending on factors such as area, possession course, and monitoring. Still, a number that many capitalists aim for is to defeat the ordinary returns of the S&P 500what numerous individuals refer to when they say, "the market." The rising cost of living hedging ability of realty comes from the positive partnership in between GDP growth and the demand for genuine estate.

Indicators on Property By Helander Llc You Need To Know

This, consequently, converts into greater capital worths. Real estate has a tendency to keep the buying power of resources by passing some of the inflationary pressure on to renters and by including some of the inflationary pressure in the type of funding admiration. Mortgage loaning discrimination is prohibited. If you think you've been victimized based upon race, religion, sex, marital condition, usage of public aid, national origin, handicap, or age, there are steps you can take.

Indirect genuine estate investing entails no straight possession of a building or homes. There are numerous ways that owning actual estate can shield versus inflation.

Residential properties funded with a fixed-rate funding will certainly see the family member quantity of the monthly mortgage repayments fall over time-- for More Help instance $1,000 a month as a fixed repayment will end up being less burdensome as rising cost of living deteriorates the buying power of that $1,000. (https://www.kickstarter.com/profile/pbhelanderllc/about). Typically, a main house is ruled out to be a realty investment given that it is made use of as one's home

9 Simple Techniques For Property By Helander Llc

Despite having the aid of a broker, it can take a few weeks of work just to locate the appropriate counterparty. Still, real estate is a distinctive asset class that's basic to understand and can enhance the risk-and-return profile of an investor's portfolio. On its own, realty supplies capital, tax obligation breaks, equity structure, affordable risk-adjusted returns, and a bush versus rising cost of living.

Purchasing realty can be an unbelievably gratifying and profitable venture, however if you're like a whole lot of brand-new capitalists, you might be asking yourself WHY you should be buying genuine estate and what benefits it brings over other investment possibilities. In enhancement to all the fantastic benefits that come along with spending in real estate, there are some downsides you require to think about.

What Does Property By Helander Llc Mean?

If you're looking for a means to acquire right into the realty market without needing to invest thousands of thousands of dollars, look into our buildings. At BuyProperly, we use a fractional possession model that enables financiers to begin with as low as $2500. One more major benefit of property investing is the capability to make a high return from acquiring, refurbishing, and marketing (a.k.a.

The Best Guide To Property By Helander Llc

If you are billing $2,000 rent per month and you sustained $1,500 in tax-deductible expenses per month, you will just be paying tax obligation on that $500 profit per month (Sandpoint Idaho land for sale). That's a big distinction from paying taxes on $2,000 per month. The profit that you make on your rental device for the year is thought about rental revenue and will certainly be strained as necessary

Report this page